Introduction to cagr formula excel

cagr formula excel When analyzing investments, business growth, or financial performance, the Compound Annual Growth Rate (CAGR) is one of the most effective metrics. Unlike simple growth rates, CAGR provides a smoothed annual rate of return over a given period, making it ideal for understanding consistent growth trends. Excel is a cagr formula excel powerful tool that helps calculate CAGR efficiently. In this article, we’ll explore the importance of CAGR, how to use its formula in Excel, and various tips to enhance financial analysis.

Understanding CAGR: What It Represents

CAGR stands for Compound Annual cagr formula excel Growth Rate, which measures the rate at which an investment grows annually over a specified period, assuming the growth happens at a steady pace. It eliminates fluctuations and provides a clearer picture of long-term growth trends.

Why CAGR Matters

Smoother Growth Representation – Unlike cagr formula excel year-over-year growth rates that can be erratic, CAGR normalizes growth over multiple years. Investment Performance Analysis – Investors use CAGR to evaluate returns over time. Business Revenue and Market Trends – Companies analyze CAGR to measure expansion and make strategic decisions.

The CAGR Formula in Excel

Excel does not have a direct CAGR function, but cagr formula excel the formula can be applied using basic mathematical functions. The formula for CAGR is:

Where:

- End Value = The final investment or revenue amount

- Start Value = The initial investment or revenue amount

- n = Number of years

How to Calculate CAGR in Excel

There are multiple ways to calculate cagr formula excel CAGR in Excel, from direct formulas to using built-in functions like POWER. Below are the most common methods:

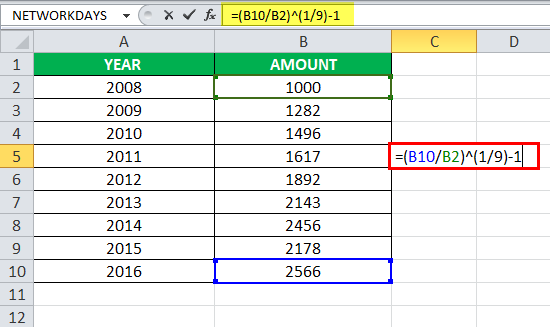

Using the Basic CAGR Formula

- Open Excel and enter your data:

- A1: Start Value (e.g., 10,000)

- A2: End Value (e.g., 20,000)

- A3: Years (e.g., 5) In an empty cell, enter the formula:

=(A2/A1)^(1/A3)-1Press Enter, and Excel will calculate the CAGR percentage.

Using the POWER Function

The POWER function simplifies exponentiation in Excel:

=POWER(A2/A1,1/A3)-1This method is more readable and eliminates manual exponent calculations.

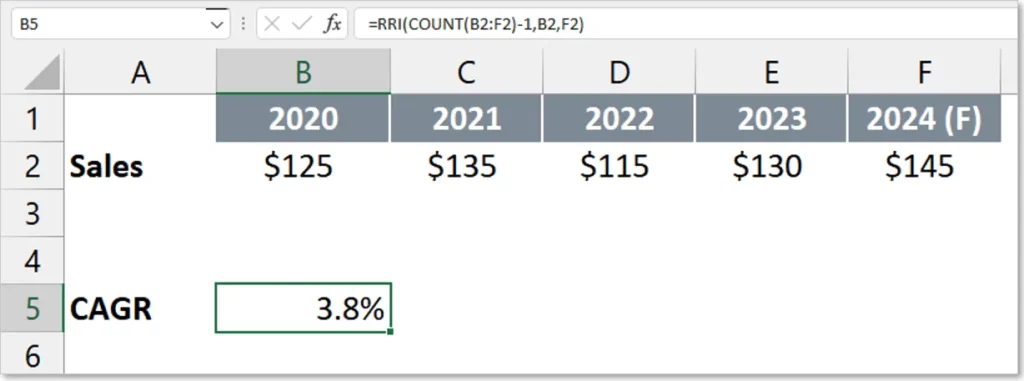

Using the RRI Function

Excel’s RRI function can calculate CAGR directly:

=RRI(A3, A1, A2)This function automates the formula, reducing errors and improving efficiency.

Examples of CAGR Calculations in Excel

Example 1: Investment Growth

Assume you invested $5,000 in a stock, and after 7 years, its value grew to $12,000.

- Start Value = 5000

- End Value = 12000

- Number of Years = 7

Using the formula:

=(12000/5000)^(1/7)-1The CAGR is approximately 12.79%.

Example 2: Business Revenue Growth

A company had revenue of $1.2 million five years ago and now generates $2.8 million.

=(2,800,000/1,200,000)^(1/5)-1The CAGR is about 18.73%.

Advantages of Using CAGR in Excel

Quick and Accurate Calculations

Using Excel eliminates human errors in manual calculations.

Visual Representation with Charts

You can use Excel charts to visualize growth trends:

- Insert a line chart to show revenue growth over time.

- Use a bar chart to compare CAGR across different investments.

Automation with Macros

For large datasets, creating a macro can automate CAGR calculations for multiple data points.

Limitations of CAGR and Alternative Metrics

While CAGR is useful, it has some limitations:

- Does not reflect volatility – CAGR assumes a smooth growth rate, but actual investments fluctuate.

- Not ideal for short-term analysis – CAGR is best for long-term trends.

- Alternative metrics – Metrics like IRR (Internal Rate of Return) and XIRR (Extended Internal Rate of Return) account for irregular cash flows.

Common Mistakes When Using CAGR in Excel

Forgetting to Subtract 1

The formula requires subtracting 1 at the end to convert the ratio into a percentage.

Using Wrong Time Period

Make sure the number of years (n) is accurate; otherwise, CAGR results will be incorrect.

Confusing with Average Growth Rate

CAGR is different from an arithmetic average; it represents compound growth.

Conclusion:

CAGR is a valuable metric for measuring growth in investments, revenue, and business performance. Excel offers multiple ways to calculate CAGR, including the standard formula, POWER function, and RRI function. Understanding how to use CAGR effectively cagr formula excel can enhance financial analysis and decision-making. By avoiding common mistakes and leveraging Excel’s features, you can ensure accurate and insightful calculations for your financial data.